Diane Chime, Chief of Capital Markets

OBM Investor Relations

OBM Investor Relations

Learn about OBM Investor Relations including our News & Press Releases.

Have questions? Reach out to us directly.

Learn about OBM Investor Relations including our News & Press Releases.

The Ohio Office of Budget and Management (OBM) is a cabinet-level agency within the executive branch of the Ohio state government. The director of OBM sits on the Governor's cabinet as the Governor's chief financial officer.

The mission of OBM is to provide financial management and policy analysis to help ensure the responsible use of state resources. In fulfilling its mission, OBM coordinates, develops, and monitors agency operating and capital budgets, and reviews, processes, and reports financial transactions made by state agencies. OBM also assists the Governor and other state agencies by providing policy and management support relative to the state's fiscal activities.

Ohio Governor Mike DeWine, Lt. Governor Jon Husted, and Ohio Office of Budget and Management (OBM) Director Kimberly Murnieks announced that S&P Global Ratings upgraded the state’s issuer default and general obligation bond ratings to “AAA,” citing Ohio’s demonstrated commitment to active budget management, building and maintaining reserves, significant state-supported economic diversification efforts, and a belief that the state can maintain better credit characteristics than the U.S. in a stress scenario.

This is the first time that Ohio has been rated "AAA/Aaa" by all three rating agencies.

“Achieving this rating from not just one, but all three major credit agencies is historic,” said Governor DeWine. “This remarkable financial milestone underscores that Ohio is at the forefront of financial excellence and economic innovation. Our strategies are yielding tangible benefits, making Ohio a prime destination for businesses and families.”

In just over one year, S&P Global Ratings, Moody’s Investors Service, and Fitch Ratings upgraded Ohio’s issuer default and general obligation bond ratings to the highest ratings possible: “AAA/Aaa/AAA.”

“This third Triple-A rating is a testament to Ohio’s unmatched economic strength and fiscal responsibility," said Lt. Governor Jon Husted. "Our budgetary leadership, combined with strategic investments in diverse sectors, has paid off immensely. We’re not just maintaining a balanced budget, we are fostering a flourishing economy that promises limitless opportunities for every Ohioan, now and in the future.”

“Under Governor DeWine’s visionary leadership, Ohio has reached new heights in financial stability and economic growth,” said Kimberly Murnieks, director of the Ohio Office of Budget and Management. “Our state’s financial foundations are more robust than ever, paving the way for continued prosperity and growth. Ohio’s journey of strategic and intentional financial planning has led us to this pinnacle of success and has firmly established our state as a leader in fiscal management. All Ohioans will benefit from the cost savings that will be realized by achieving the 'Triple-A Triple Crown.'"

The S&P Global Ratings “AAA” credit upgrade comes exactly one week after Moody’s Investors Service elevated Ohio’s rating to “Aaa” and one year after Fitch Ratings upgraded the State to “AAA.”

Ohio’s “AAA/Aaa” ratings upgrade comes in connection with the state’s planned issuance of approximately $393 million in General Obligation Refunding Bonds expected to price the week of December 12.

Simultaneously with the change to Ohio’s issuer rating, S&P Global Ratings raised its long-term rating on the State of Ohio’s general obligation (GO) bonds to “AAA” from “AA+,” assigned the “AAA” long-term rating to the State of Ohio’s approximately $391 million series 2023 refunding bonds, raised its long-term rating on the tax credit bonds issued by the Columbus-Franklin County Finance Authority to “AA” from “AA-,” raised the dual rating on the state’s GO debt outstanding to “AAA/A-1+” from “AA+/A-1+,” and raised its dual rating on the state’s lease-appropriation debt to “AA+/A-1+” from “AA/A-1+.”

Moody's Investors Service Friday lifted Ohio's issuer default and general obligation ratings to triple-A based on strong financial management and an economy that's "poised for diversification and growth."

The state now boasts the coveted top issuer rating from Moody's and Fitch Ratings, which upgraded it in September, 2022. S&P Global Ratings pegs the state one notch below the top mark at AA+ with a stable outlook.

Moody's upgrade reflects Ohio's "sound budgetary and financial management, highlighted by a trend of strong and growing reserves and liquidity, and affordable fixed costs associated with Ohio's low and declining leverage," the agency said in the upgrade report.

Though the state's economic and demographic trends have typically lagged the nation and "that will not change rapidly," Moody's predicted that "recent major investments related to electric vehicles and microchips will drive growth in high paying manufacturing jobs."

Moody's last rated Ohio with its highest credit rating in 1979, according to the state.

Republican Gov. Mike DeWine called the upgrade "strong external validation that our strategy is delivering results for Ohio. I am proud that our record shows we are the best state to live, grow or start a business, and raise a family."

The upgrade affects $6.7 billion of Moody's-rated GO bonds, which includes $864 million of highway capital improvement bonds that feature a GO pledge. The ratings agency also upgraded $2.9 billion of outstanding lease appropriation bonds and certificates of participation to Aa1 from Aa2.

Moody's lifted several other state-related credits, including $879 million of Garvee bonds issued by the Ohio Department of Transportation.

"Our finances are stronger than at any time in history, our economy is surging ahead, and our budget is focused on ensuring that all corners of Ohio grow," said Ohio Office of Budget and Management Director Kimberly Murnieks in a statement. "We have reduced taxes and invested in results, and our priorities will continue to provide unlimited opportunities for Ohioans."

The upgrade makes Ohio the 17th state that's rated Aaa by Moody's.

Moody’s Investors Service last rated Ohio with its highest credit rating in 1979.

(COLUMBUS, Ohio)— Ohio Governor Mike DeWine, Lt. Governor Jon Husted, and Ohio Office of Budget and Management (OBM) Director Kimberly Murnieks announced today that the credit rating agency Moody’s Investors Service upgraded Ohio’s Issuer Rating to “Aaa” from “Aa1” citing a “continuing trend of very strong financial management, improving reserves and liquidity, low and declining leverage and a state economy that is poised for diversification and growth.”

"Moody’s decision to upgrade Ohio's rating to 'Aaa' is strong external validation that our strategy is delivering results for Ohio," said Governor DeWine. "Ohio is the heart of it all, and I am proud that our record shows we are the best state to live, grow or start a business, and raise a family."

"Ohio’s economy and the state's financial footing are both stronger than ever before and we will keep building on our winning record into the future," said Lt. Governor Husted. "This is the most success that Ohio has achieved in decades and our progress is built on careful, intentional planning that is paying off. This upgrade from Moody’s is more proof that our state is fiscally strong and expertly managed.”

“Under Governor DeWine’s leadership, Ohio continues to build on our record of success," said Director Murnieks. "Our finances are stronger than at any time in history, our economy is surging ahead, and our budget is focused on ensuring that all corners of Ohio grow. We have reduced taxes and invested in results, and our priorities will continue to provide unlimited opportunities for Ohioans – today and for generations in the future.”

Ohio’s “Aaa” long-term Issuer Rating reflects a trend of positive demographics that Moody’s expects “to continue as the announced economic development projects come online over the medium term. The outlook also incorporates the state’s strong financial position, including its purposeful efforts to build reserves and budget conservatively that will support Ohio’s strong credit quality going forward.

The Moody’s “Aaa” credit upgrade comes one year after the organization elevated Ohio’s credit outlook to positive and Fitch Ratings upgraded the State Issuer Default Rating to “AAA.”

Ohio’s “Aaa” rating upgrade comes in connection with the State’s planned issuance of approximately $393 million in General Obligation Refunding Bonds expected to price the week of December 12.

Simultaneously with the change to the State’s issuer rating, Moody’s upgraded the general obligation bonds including the GO highway program to “Aaa” from “Aa1”, lease appropriation debt and certificates of participation (COPs) to “Aa1” from “Aa2”, the Ohio Community and Technical College Credit Enhancement and Ohio School District Credit Enhancement programs to “Aa1” from “Aa2”; and the rating on the Ohio Department of Transportation (ODOT) Federal Grant Anticipation Program's outstanding Major New State Infrastructure Project bonds, also known as GARVEE bonds.

With limited exceptions, the Ohio Constitution prohibits the incurrence or assumption of debt by the state without a popular vote. The state may incur debt to cover casual deficits or failures in revenues, or to meet expenses not otherwise provided for, but this power is limited in amount to $750,000. The Constitution expressly precludes the state from assuming the debts of any county, city, town or township, or of any corporation (though an exception in both cases is for debts incurred to repel invasion, suppress insurrection, or defend the state in war). Issuance of state debt paid from the state's general fund is subject to the Constitutional 5% debt service limitation.

The state of Ohio has two primary issuers of debt for which the state is the direct obligor and debt service is paid from state revenues. These issuers are the Ohio Public Facilities Commission and the Treasurer of State. The table below shows the purposes of bonds issued by each and the source of state funds used to pay debt service on those bonds.

Ohio Public Facilities Commission - The Ohio Public Facilities Commission (OPFC) is a body corporate and politic constituting an agency and instrumentality of the state. It is comprised of six members, being the incumbents in the elective offices of Governor, Attorney General, Auditor of State, Secretary of State, Treasurer of State, and the OBM Director. The governor serves as the chair, the Treasurer of State as the treasurer and the Director of the Office of Budget and Management as the secretary of the Commission. Commission members may, at Commission meetings, act through their appointed designees. The OPFC acts as the issuer of the state general obligation debt authorized by the Ohio General Assembly that is backed by the general revenue fund.

Treasurer of State - The Ohio Treasurer of State (TOS) acts as issuer of the general and special obligation direct debt listed below. The TOS also is the issuer of other obligations backed by dedicated state non-tax revenues and is a conduit issuer for industrial development bond programs (e.g., the Ohio Department of Development Enterprise Bond Fund).

| security_/_purpose">security_/purpose">security/_purpose">SECURITY / PURPOSE | issuer">issuer">issuer">ISSUER | source_of_state_payment">source_of_state_payment">source_of_state_payment">SOURCE OF STATE PAYMENT |

|---|---|---|

| General Obligations | ||

| Higher Education | OPFC | General Revenue Funds |

| Common Schools | OPFC | General Revenue Funds |

| Coal Development | OPFC | General Revenue Funds |

| Natural Resources | OPFC | General Revenue Funds |

| Conservation | OPFC | General Revenue Funds |

| Local Infrastructure | OPFC | General Revenue Funds |

| Third Frontier R&D | OPFC | General Revenue Funds |

| Site Development | OPFC | General Revenue Funds |

| Veterans Compensation | OPFC | General Revenue Funds |

| Highways | TOS | Highway User Receipts |

| Special Obligations (Lease Rental) | ||

| Mental Health | TOS | General Revenue Funds |

| Parks and Recreation | TOS | General Revenue Funds |

| Cultural & Sports Facilities | TOS | General Revenue Funds |

| Higher Education | TOS | General Revenue Funds |

| Administrative Facilities | TOS | General Revenue Funds |

| Correctional Facilities | TOS | General Revenue Funds |

| Youth Services Facilities | TOS | General Revenue Funds |

| Public Safety Facilities | TOS | Highway User Receipts |

| BWC Facilities | TOS | WC Admin. Cost Fund |

| Other Obligations | ||

| State Highway Infrastructure (GARVEE) | TOS | Federal Transportation Grants |

By 20 constitutional amendments approved from 1921 to present, Ohio voters have authorized the incurrence of state general obligation (GO) debt and the pledge of taxes and excises to its payment. Exceptions or limitations are for highway user receipts, which may only be used to pay debt service on bonds issued for highway projects and net state lottery proceeds, which may only be used for debt service for public primary and secondary education facilities.

The Ohio Public Facilities Commission and the Treasurer of State are the only currently authorized issuers of the state's GO debt.

The Ohio Public Facilities Commission (OPFC) issues general obligation bonds for common schools, higher education, natural resources, coal research and development, conservation projects, local infrastructure improvements, Third Frontier research and development, job-ready site development, and veterans' compensation. Each of these currently authorized programs is described below.

Coal Research and Development - A 1985 constitutional amendment authorizes $100 million of general obligation debt to be issued to finance grants, loans, or loan guarantees for research, development, and implementation of coal technology that will encourage the use of Ohio coal. Funding is available to any individual, association, or corporation doing business, or to any educational or scientific institution located in the state. Additional debt may be issued as outstanding debt is retired, provided that not more than $100 million is outstanding at any time.

Common Schools - A 1999 constitutional amendment authorizes general obligation debt to be issued to pay the costs of school buildings and related capital facilities for a system of common schools throughout the state. There is no constitutional limit on the amount of debt that can be outstanding at any time. The full faith and credit, revenue (including net state lottery proceeds, if pledged) and taxing power (excluding highway user receipts) of the state are pledged to retire this debt.

Conservation - Constitutional amendments in 2008 and 2000 authorize $400 million of general obligation debt to be issued to finance preservation of green space and natural areas, development of recreational trails, and protection of farmland through the purchase of agricultural easements, all through partnerships with local governments. Not more than $50 million may be issued in any fiscal year. Additional debt may be issued as outstanding debt is retired, provided that not more than $400 million is outstanding at any time.

Higher Education - A 1999 constitutional amendment authorizes general obligation debt to be issued to pay the cost of school buildings and related capital facilities for state-supported and state-assisted institutions of higher education. There is no constitutional limit on the amount of debt that can be outstanding at any time.

Infrastructure Improvements - A 2014 constitutional amendment authorized $1.875 billion of general obligation debt as a 10-year extension of this program to finance public infrastructure capital improvements of municipal corporations, counties, townships, and other local government entities as designated by law, with an annual issuance limit of $175 million in the first five years increasing to $200 million in the second five-years. This extension followed a prior 10-year extension passed in 2005 which authorized an additional $1.35 billion of general obligation debt. Additionally, there were two prior debt authorizations for this purpose (passed in 1985 and 1995) that each authorized $1.2 billion in debt.

Natural Resources - A 1993 constitutional amendment authorizes $200 million of general obligation debt to be issued to finance capital facilities for parks and natural resources improvements. Additional debt may be issued as outstanding debt is retired, provided that no more than $200 million is outstanding at any time. Not more than $50 million may be issued in any fiscal year. The full faith and credit, revenue (excluding net state lottery proceeds), and taxing power (excluding highway user receipts) of the state are pledged to retire this debt.

Site Development - A 2005 constitutional amendment authorizes the issuance of $150 million of general obligation debt for the development of sites for industry, commerce, distribution, and research and development by preparing those sites for immediate development by business prospects. Not more than $30 million was permitted to be issued in each of the first three fiscal years and not more than $15 million in any other fiscal year.

Third Frontier Research and Development - Constitutional amendments in 2010 and 2005 authorize the issuance of $1.2 billion of general obligation debt to provide grants to nonprofit and for-profit entities for research and development projects in support of Ohio industry, commerce and business. Project awards focus on biosciences, advanced materials, information technology, power and propulsion, and instruments-controls-electronics. No more than $450 million total may be issued in state fiscal years 2006 through 2011, no more than $225 million in fiscal year 2012 and no more than $175 million in any fiscal year thereafter.

Veterans' Compensation - A 2009 constitutional amendment authorizes the issuance of state general obligation debt to provide compensation to persons who have served in active duty in the United States armed forces at any time during the Persian Gulf, Afghanistan, and Iraq conflicts. Not more than $200 million may be issued and no obligations may be issued later than December 31, 2013.

The Treasurer of State issues general obligation bonds for highway construction, as summarized below.

Highway (Capital Improvements) - A 1995 constitutional amendment authorizes the issuance of general obligation debt for construction for the cost of construction, reconstruction, or other improvements of highways, including those on the state highway system and urban extensions, those within or leading to public parks or recreations areas, and those within or leading to municipalities. The amendment provides that as this debt is retired additional debt may be issued so long as no more than $1.2 billion is outstanding at any time. No more than $220 million may be issued in any fiscal year. Though secured by the state's full faith and credit, debt service has always been paid from pledged highway user receipts (including motor vehicle fuel tax receipts).

State special obligation debt, the owners or holders of which are not given the right to have excises or taxes pledged to the payment of debt service, is authorized for specified purposes by Section 2i of Article VIII of the Ohio Constitution. Debt service payments are subject to biennial appropriations made in the benefitting agency's operating budget pursuant to leases or agreements entered into by those agencies. The Treasurer of State is the current issuer of the state's special obligation lease-rental bonds.

The Treasurer issues lease-rental obligations to house branches and agencies of state government or its functions, including facilities for mental health, parks and recreation, cultural and sports purposes, prisons and corrections, juvenile detention, and state office buildings and facilities for the Departments of Administrative Services, Transportation, and Public Safety and for the Bureau of Workers' Compensation.

Debt service on special obligations is generally paid from the GRF, with the exception of debt issued for DOT and DPS facilities which is paid from highway user receipts.

The Treasurer of State issues Major New State Infrastructure Project Revenue Bonds (also known as Grant Anticipation Revenue Vehicles or GARVEEs) to fund selected highway construction projects that have been approved by the U.S. Department of Transportation. The debt service charges on these bonds are secured by and payable primarily from Federal Title 23 Highway Funds received and to be received by the state, subject to biennial appropriations by the General Assembly.

State agencies have also entered into lease-purchase agreements with terms ranging from 7 to 10 years primarily to finance information technology projects and capital equipment. Certificates of Participation (COPs) have been issued that represent fractionalized interests in or are payable from state payments made under those agreements. Payments by the state are subject to biennial appropriations by the General Assembly and the holders or owners of the COPs have no right to have excises or taxes levied to make those payments. The OBM Director's approval of such agreements is required if COPs are to be publicly-offered in connection with those agreements. COPs have been issued to finance the acquisition and installation of the following information systems and equipment:

Bureau of Criminal Investigation Records System (BCIRS) - BCIRS is a criminal records management and biometric identification system administered by the Ohio Attorney General's office that replaced the state's computerized criminal history and automated fingerprint identification systems.

Enterprise Data Center Solutions (EDCS) - EDCS is an information technology program to expand and improve the state's cloud computing environment and support upgrades to enterprise shared solutions.

Multi-Agency Radio Communications System Project (MARCS) - MARCS is a statewide computer and communications network administered by the Department of Administrative Services that is designed to provide instant voice and data communication and supply a communications backbone to the public safety and emergency management.

Ohio Administrative Knowledge System (OAKS) - OAKS is an enterprise resource planning system was implemented to support the common back office operations of the state. The major statewide business functions supported by OAKS include capital improvements, financials, fixed assets, procurement, and human resources and payroll.

State Taxation Revenue and Accounting System (STARS) - STARS is an integrated tax collection and audit system administered by the Ohio Department of Taxation that replaced the state's separate tax software and administration systems.

Treasury Management System (TMS) - TMS is an integrated treasury technology infrastructure system that replaced the Treasurer of State's separate cash, custody, investment, and accounting software and administration systems.

Unemployment Insurance System (UIS) - UIS is an unemployment insurance information and technology system for the use of the Department of Job and Family Services.

Voting Systems - The voting systems acquisition program is administered by the Secretary of State's office to acquire and implement new voting systems for all Ohio counties.

Revenue bonds are used by the state to finance a specific project or category of projects. Debt service is secured by and paid from revenues or fees that are charged for the use of facilities. Various state authorities and commissions have been created by the General Assembly to issue revenue bonds. These include the Ohio Turnpike and Infrastructure Commission, the Ohio Housing Finance Agency, the Ohio Water Development Authority, and the Petroleum Underground Storage Tank Release Compensation Board. The funds borrowed by these authorities and the funds for the debt service payments on their obligations are outside the state treasury and are not appropriated by the legislature.

The Department of Development, the Ohio Water Development Authority, the Ohio Air Quality Development Authority, the Ohio Housing Finance Agency and the Ohio Higher Education Facilities Commission also issue conduit bonds for economic development, pollution control and solid waste, housing and private higher education projects. The debt service on those conduit bonds is paid solely by the benefited business or entity.

The state provides credit enhancement programs for school districts and two-year community and technical colleges to help reduce the cost of borrowing for certain capital projects. Under these programs, the state and the school district or college enter into an intercept agreement under which, in the event that debt service on the applicable debt obligations are not able to be made in full and on time, the state is authorized to withhold funds that would otherwise be paid to the school district or college and divert those funds to payment of debt service on the debt obligations. This credit enhancement typically results in a higher credit rating than the school district or college could obtain on a stand-alone basis. The higher credit rating enhances the security and improves the marketability of the bonds thereby resulting in a lower borrowing cost.

School Districts - The Ohio Department of Education administers the state's credit enhancement program for school districts pursuant to Section 3317.18 of the Ohio Revised Code. That section, as further implemented by OAC rule 3301-8-1, sets forth the application requirements, eligibility criteria, and the procedural steps by which the intercept mechanism will be used for the payment of debt service in the event an institution is unable to make such payments. For additional information on the school district credit enhancement program, please contact the Ohio Department of Education.

Two-Year Community and Technical Colleges - The Ohio Department of Higher Education administers the state's credit enhancement program for two-year community and technical colleges pursuant to Section 3333.59 of the Ohio Revised Code. That section, as further implemented by OAC Rule 3333-1-15, sets forth the application requirements, eligibility criteria, and the procedural steps by which the intercept mechanism will be used for the payment of debt service in the event a college is unable to make such payments. Under the program, colleges have the option of consolidating their separate issuances into a single offering issued by the Treasurer of State. For additional information on the community and technical college credit enhancement program, please contact the Ohio Department of Higher Education.

Other bond issuing authorities have been created by the state to administer programs or projects financed through the issuance of revenue bonds the debt service on which is secured by and paid from revenues or fees that are charged for the use of the facilities. Those issuers are:

Ohio Turnpike and Infrastructure Commission

Ohio Water Development Authority

Petroleum Underground Storage Tank Release Compensation Board

Conduit bonds are also issued by certain state agencies to finance industrial or commercial projects, air and water pollution control and solid waste disposal facilities, and private higher education institutions. Debt service on those conduit obligations is payable solely from the benefited business or other non-public entity. State issuers of conduit bonds include:

Development Services Agency (Ohio Enterprise Bond Fund)

Higher Educational Facilities Commission

Ohio Water Development Authority

Ohio Air Quality Development Authority

Section 126.11 of the Ohio Revised Code sets forth OBM's role and responsibilities with respect to managing existing state debt and proposed issuances of new state debt. For proposed sales of new state debt, OBM must review and approve each sale including the amount, security, source of payment, structure and maturity schedule. OBM is also charged with reviewing and commenting on the resolution or order authorizing the sale and the preliminary and final official statements. Following each sale, issuers are to provide OBM with a final transcript of documents relating to the sale including the final debt service schedules, prices and yields.

OBM is also charged with developing and distributing a coordinated bond sale schedule for certain state bond issuing authorities. The coordinated bond sale calendar is published monthly and includes projected sales over the next six months for the following issuers: i) Ohio Public Facilities Commission; ii) Treasurer of State; iii) Ohio Housing Finance Agency; iv) Ohio Water Development Authority; v) Ohio Turnpike Authority, and vi) Petroleum Underground Storage Tanks Release Compensation Board.

OBM also serves as the provider of official disclosure information relating to state debt, state budgeting and finances, certain economic and demographic information, and other information required under federal continuing disclosure regulations. This is accomplished through submission of an annual information report (including accompanying annual financial reports) and the submission of timely reports of the occurrence of any specified material events. Copies of the state's annual disclosures and material event notices are available through the Electronic Municipal Market Access (EMMA) system. EMMA has been designated as the official source of municipal disclosure by the Municipal Securities Rulemaking Board (MSRB). In addition, OBM has engaged Digital Assurance Certification, LLC (DAC) to serve as the state's primary Disclosure Dissemination Agent. The DAC Web site www.dacbond.com also gives investors access to the state's official statements and state disclosure.

With respect to the state's biennial operating budget, OBM establishes and monitors debt service appropriation line items within various agency budgets to ensure that all necessary debt service payment authorizations and associated administrative expenses are included in each budget bill. OBM also models and projects the affordable size of future capital bills within the constraint of the Constitutional 5% limitation on debt service and reviews and approves release of funds requests from state capital appropriations.

Section 17 of Article VIII of the Ohio Constitution, approved by Ohio voters in November 1999, establishes an annual debt service "cap" applicable to future issuance's of state direct obligations payable from the general revenue fund (GRF) or net state lottery proceeds. Generally, new obligations may not be issued if debt service for any future fiscal year on those new and the then outstanding bonds of those categories would exceed 5 percent of the total of estimated GRF revenues plus net state lottery proceeds for the fiscal year of issuance.

Those direct obligations of the state include general obligation and special obligation bonds that are paid from the state's GRF, but exclude (i) general obligation debt for Third Frontier Research and Development, development of sites and facilities, and veterans compensation, and (ii) general obligation debt payable from non-GRF funds (such as highway bonds that are paid from highway user receipts). Pursuant to the implementing legislation, the governor has designated the OBM Director as the state official responsible for making the 5 percent determinations and certifications. Application of the 5 percent cap may be waived in a particular instance by a three-fifths vote of each house of the Ohio General Assembly and may be changed by future constitutional amendments.

View the state's most recent 5% certification

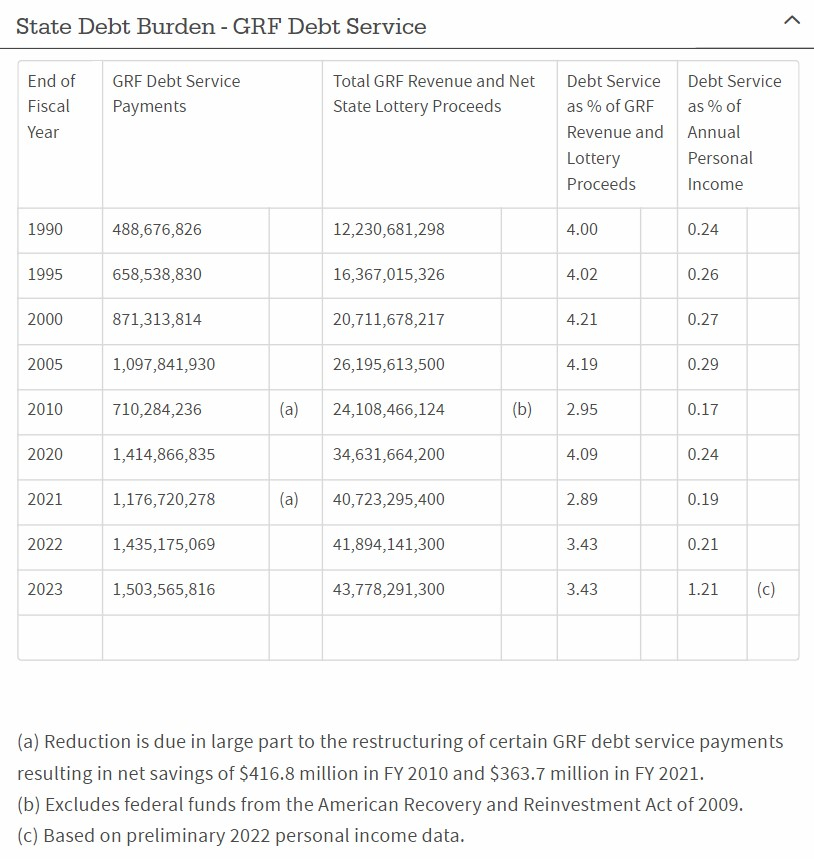

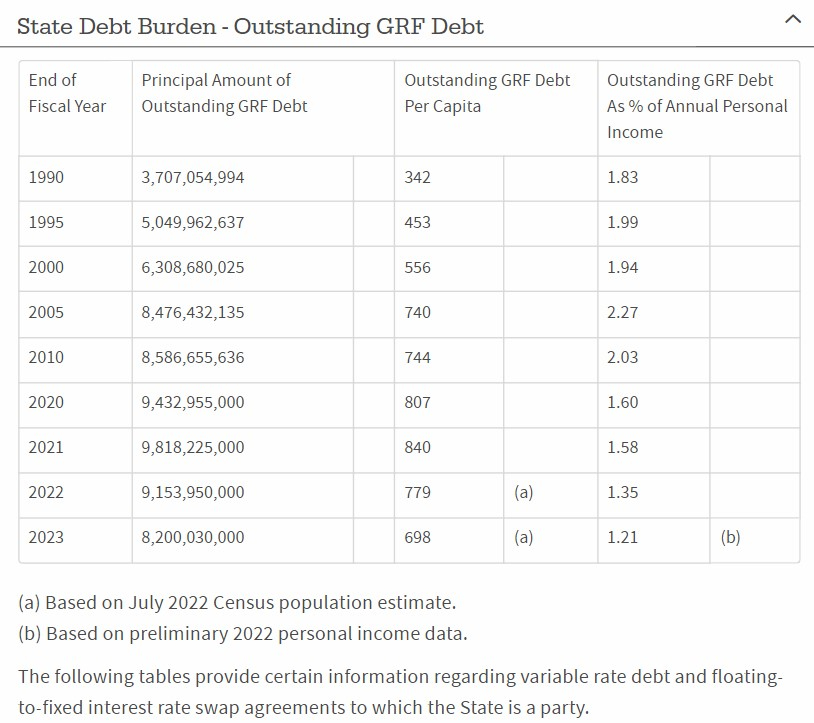

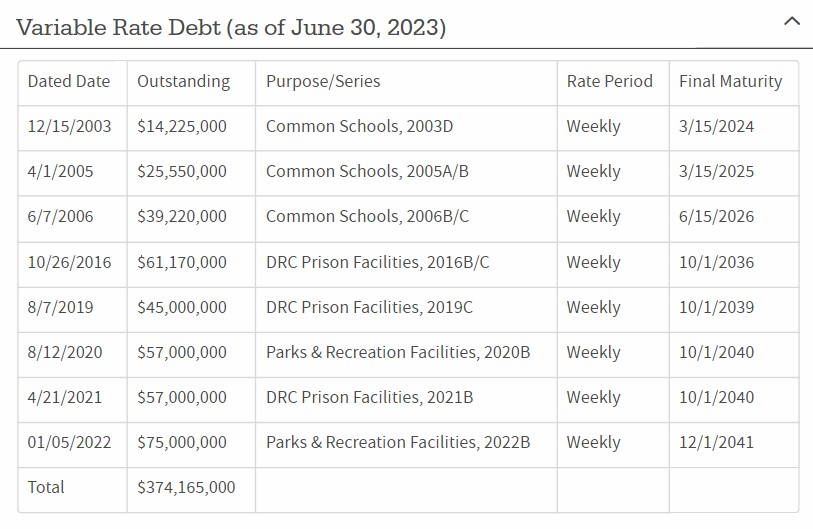

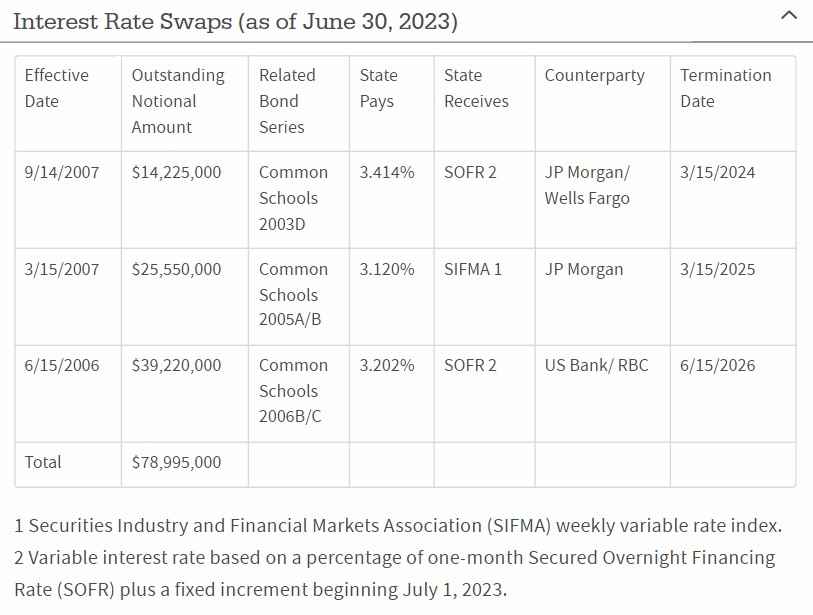

The following tables provide certain historical information and comparisons regarding debt outstanding and debt service. These tables reflect only then outstanding general and special obligation debt payable from the state’s GRF.

Have questions? Reach out to us directly.